MT4 Bridge Pricing Configuration

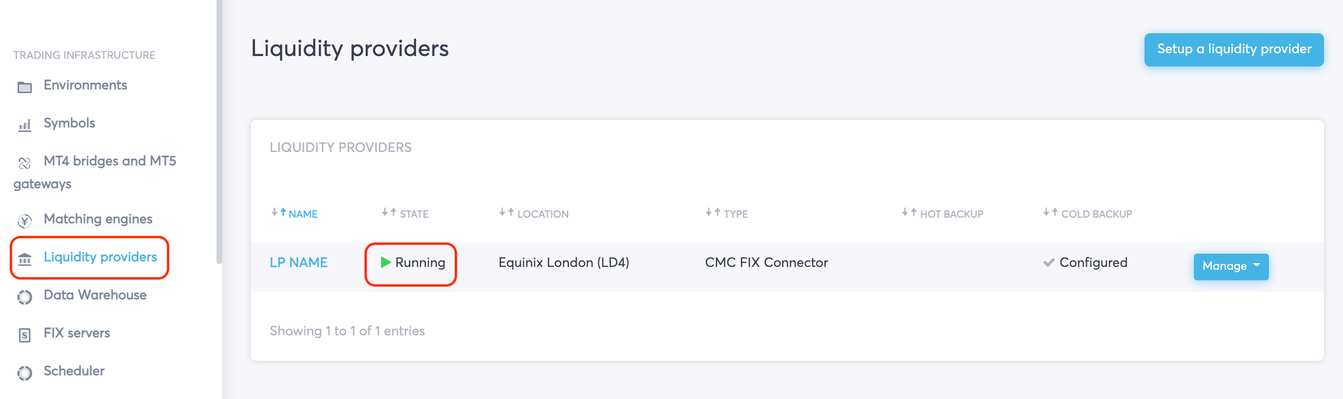

1. Add Liquidity Provider.

Add your Liquidity Provider(-s) and configure FIX sessions (quote and trade for each LP).

2. Configure your Liquidity Pool.

Go to Matching Engines, click on your Liquidity Pool, and subscribe to price streams from each LP by clicking on the respective check-boxes. If one checkbox is ticked next to a symbol, the pricing and orders for this symbol will only be sent from/to this LP. If there’s more than one LP ticked per symbol, the aggregation rules will apply to pricing and execution.

Please refer to Aggregation rules for more info about execution logic.

You will find all the symbols available in your Matching Engine in the Symbol column. If you can’t find the symbols you need, you can add them in the Symbols section in the left menu. This section serves as a symbols library.

Upon clicking on the checkbox, you may be offered to enter the correct Connector symbol name, which is the same as the FIX symbol name and can be different for each LP.

You can also configure symbol names in the Liquidity Provider section (LP Name → Manage → Configure symbol mappings).

Go to the Liquidity Providers section, choose the Liquidity Provider you want to use, and click Manage → Start.

3. Set up pricing from Liquidity Pool to MT4 Bridge.

Go to the MT4 Bridges and MT5 Gateways section and click on Manage -> Configure pricing next to your MT4 Bridge.

Now assign a liquidity pool to each symbol or click on Set unassigned to automatically assign a liquidity pool to all symbols that are not yet set.

4. Set up MT4 Pricing Parameters

MT4 Configure Pricing Page contains parameters that can be configured by user.

Each parameter can be configured in one of two ways. The first is to set up a default parameter. It can be found right under each parameter name.

After being clicked, it will lead to a new page where the default parameter can be specified.

After being configured, the parameter applies to all the symbols on MT4 that are processed by the Your Bourse bridge.

The second option is to configure the parameter per symbol. This means that the configured parameter will only work for a specific symbol.

After being clicked, it will lead to the new page where the default parameter can be specified.

If a symbol’s parameter is configured by default, it has a status “default“ next to the value. If the parameter is set up individually, it has a status “manual“ next to its value.

If there’s a contradiction between the configuration by default and per symbol, the configuration per symbol has a priority over the default value.

For instance, if Ask Markup by default is 2 and the Ask Markup for AUDCAD is 4, then 4 will be applied.

In total, there are 10 configurable parameters on the page. We will skip here the MetaTrader Symbols Names cluster of parameters as well as the Primary Liquidity Pool parameter because they are covered in the other User Guide pages.

The remaining 8 parameters are Bid Markup, Ask Markup, Minimum Spread, Maximum Spread, Target Spread, Force Target Spread and Price Markup per Volume Band.

Let’s consider them one by one.

Bid Markup - a specified value will be subtracted from the bid price making the overall spread on MT4 Market Watch wider.

Ask Markup - a specified value will be added to the ask price making the overall spread on MT4 Market Watch wider.

Minimum Spread - the spread on the MT4 Market Watch won’t be less than the specified value even if the spread from the Liquidity Provider is less.

For example, if the spread from the Liquidity Provider is 5 and the specified minimum spread is 10, the MT4 Market Watch will show 10. It’s done by adding/subtracting additional markups to ask / bid prices.

Maximum Spread - the spread on MT4 Market Watch won’t be more than the specified value even if the spread from the Liquidity Provider is bigger.

For example, if the spread from the Liquidity Provider is 25 and the specified minimum spread is 20, the MT4 Market Watch will show 20. It’s done by subtracting/adding additional markups to bid / ask prices.

Target Spread - the specified value will be used to calculate the percentage from the price. The formula for the calculation is “(bid+ask)/2 * specified value /100”.

The target spread works only if it is bigger than the spread from the Liquidity Provider. If it’s less than the spread from the LP, the latter will be used.

For instance, if the spread from LP is 10 and the target spread is 5, a spread of 10 will be used.

Force Target Spread - if this parameter is enabled, the Target Spread will also be used even if it’s less than the spread from the LP.

Price Markup per Volume Band - the specified value will be applied to the execution depending of the traded volume. A client can create his/her own layered tiers with the volumes and corresponding markups. Read the full description of the parameter here.